Works with both types of recurring payments

Both through the bank and a credit card

Fits the consumer price index

Update your prices in real-time - local and foreign currency

Self sign-up pages to save yourself time

Your clients can sign up for recurring payments on their own

Want to open a credit card recurring payment?

All you have to do is enter your credit card and recurring payment details, and we’ll take care of charging, generating documents, and notifying you if something goes wrong. The charge didn’t go through? We’ll continue to try every day until the end of the month. If we don’t succeed, the failed charge will be added to the next month.

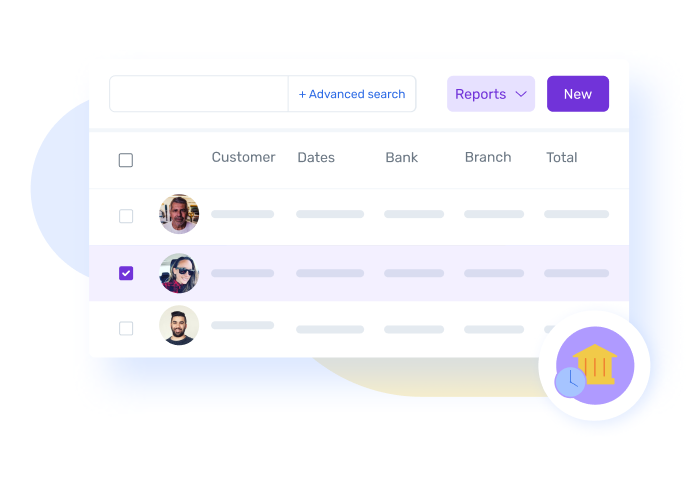

Want to open a bank recurring payment?

You’ll need to download bank-clearing software. This is the only way we can manage a bank recurring payment without paying significant service fees

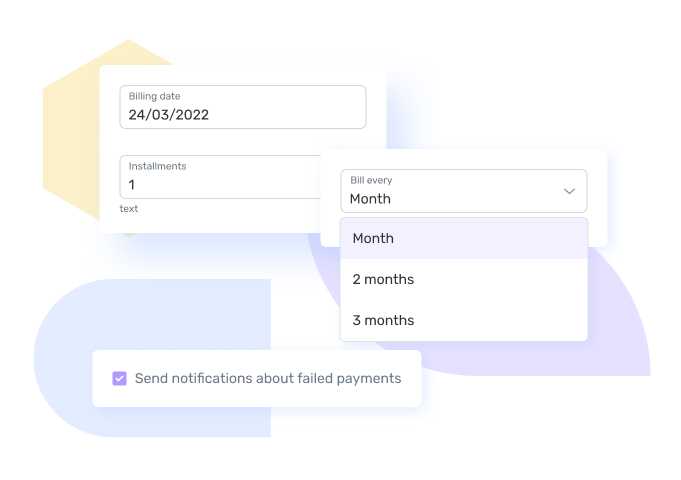

Your business, your rules

Sign up your clients for a recurring payment or let them sign up themselves with a link to the self-sign-up page? Charge every month or every three months? Use the consumer price index or foreign currency? Notify clients when a charge fails or not? Even with payments on autopilot, you still have control. Thanks, technology.

And that’s just the tip of the iceberg

If you’ve already decided to optimize your business with our recurring payment feature, why stop there? With our system, you can manage inventory, tasks, suppliers, client meetings, and even enjoy accounting services including monthly and yearly reports.

A recurring payment (also called an automatic payment or standing order) is a common payment method in which the customer authorizes the bank to charge their account or credit card with a payment request from a specific business. The charge is made at a fixed time every month, and the charge amount and length of the recurring payment can be limited. Recurring payments are typically used to pay regular bills like gas and electricity.

Recurring payments have several benefits. The main one is the peace of mind that this method offers to both the customer and the business owner. Because it’s a payment for a fixed amount transferred at fixed intervals, the business owner doesn’t have to worry about not receiving the full payment on time, and the customer doesn’t have to worry about owing interest on late payments. Not only are recurring payments useful for businesses and independent contractors, but they’re also a good way to manage a sports team or other type of organization with monthly dues.

Setting up recurring payments is a simple and fast process, and mistakes can be easily fixed. You can create a credit card recurring payment in several ways: manually, through an API, or through payment processing pages. Once the recurring payment is established in the system, you can start making transactions and managing the authorization through the interface.

Unlike credit card payments, recurring payments are executed as a debit to the account, so they do not apply to the credit card limit.

There are several differences between recurring payments through a bank or a credit card company. The payment through the bank appears in the account on the business day after the charge date, whereas a credit card company shows the payment immediately. Creating a credit card recurring payment is simpler than doing it through the bank, which requires more bureaucracy and forms. There are also differences in the fees charged, and it’s recommended to check to see which are lower.

When setting up the authorization to charge an account, business owners should make sure that all the details are available to the customer. Customers should make sure they have entered all the correct details.

Let’s get down to business

Our system is so good you’ll have to see it to believe it. That’s why we offer a 45-day free trial with the full suite of features.